child tax portal update dependents

If something happens that you are unable to get the payments you can still get the full child tax. Child tax credit portal update dependents.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account.

. Child tax credit portal update dependents. Posted by 1 day ago. Later this year the Child Tax Credit Update Portal CTC UP will be updated to allow you to inform us about the qualifying children.

CTC Update 2023 is one of the most anticipated announcements by many families in the United States. Filed a 2019 or 2020 tax return and. Here is everything you need to know about the child tax credit and other.

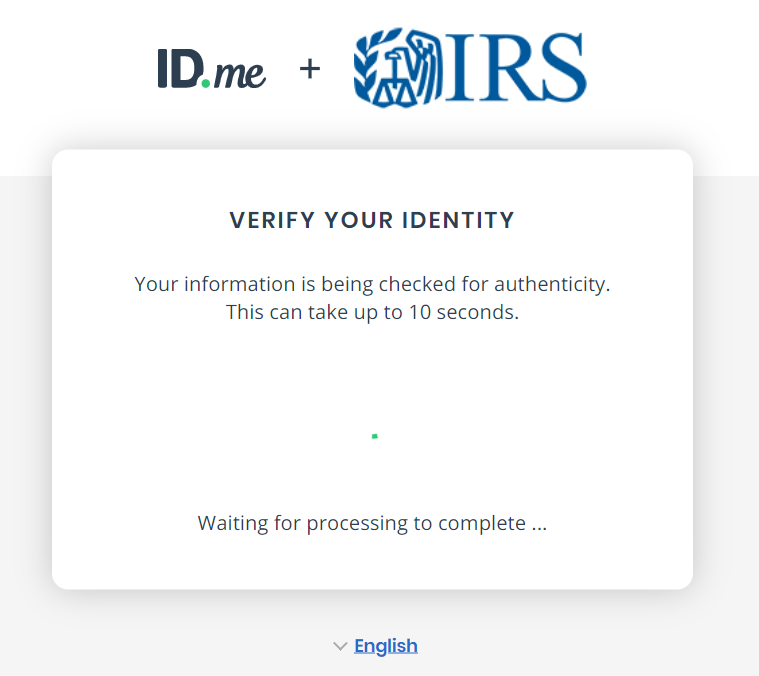

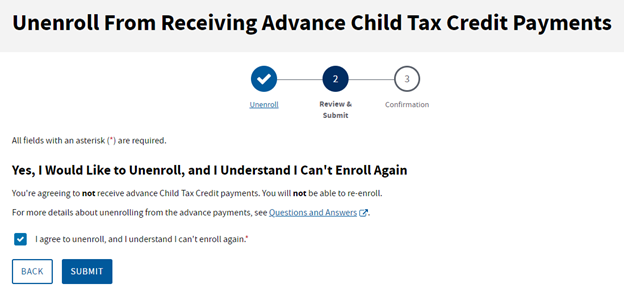

How to sign up for the Child Tax Credit. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account. The Child Tax Credit Update Portal allows you to verify that your family is eligible for the credit and to decline to receive payments in 2021.

Single or married and filing separately. The IRS will add more. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit.

The bank account update feature was added to the Child Tax Credit Update Portal available only on IRSgov. Heres how they help parents with eligible dependents. You can use it now to view your.

The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child. You must have claimed at least one child as a. Its gotta be coming in the next few days since the deadline to submit for the final.

Update Dependents Portal Feature. To apply applicants should visit. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving.

At some point the portal will be updated to allow you to update how many dependants you have. It also lets recipients opt out of advance payments in favor of a one. The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance payments.

The IRS is yet to release any information about when it will be possible to update dependent details on the portal. Update Dependents Portal Feature.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit Update How To Change Your Bank Info Online Money

Irs Glitch Causes Delays To Child Tax Credit Payments

Child Tax Credit Update Next Payment Coming On November 15 Marca

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Child Tax Credit Update Irs Launches Two Online Portals

Irs Launches New Online Tool To Help Manage Child Tax Credit Nextadvisor With Time

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs

Advanced Child Tax Credit Payments Miller Verchota Cpas

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Status Of Child Tax Credit Where Is It Do You Want It

Shannon Raasch Cpa The Tax Crusader Advance Child Tax Credit If You Have A Dependent Child Under Age 18 You Are Affected The New Irs Portal Will Provide Overview

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Advance Ctc Payments Integrity Tax Group

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It